Share this

Optimizing Banking Business Process with BPM

by Erin Esterberg on September 16, 2022 5:26:13 AM EDT

In general, the banking industry and the financial sector are getting more competitive every year: customers demand more convenience and speed with every banking transaction, yet maintaining accuracy is also a must.

In short, banks are expected to be more productive and efficient to stay competitive.

This is why the topic of implementing Business Process Management Software (BPM) in banking has garnered significant interest in recent years. Optimizing and automating banking processes are necessary for every bank to keep up with the rapidly evolving customer expectations and tight competition.

This guide will discuss how implementing BPM and Business Process Management Software can help banks improve their efficiency and how to use BPM solutions to achieve this purpose effectively.

By the end of this guide, you'd have learned about:

-

What is Business Process Management (BPM)?

-

Standard business processes in banking and their challenges

-

-

How BPM can improve a bank's efficiency and productivity

-

The implementation of BPM in banking

-

Automating banking business processes with the help of Business Process Management Software

Let us begin with the basics: what is Business Process Management?

What is BPM?

BPM, or Business Process Management, is a structured approach to optimizing an organization's business processes to achieve its objectives with fewer resources (including time.)

A business process is an action or set of activities (tasks) that is repeatable and, when accomplished, will help the organization achieve a specific goal. These goals can be acquiring more customers/clients, generating more revenue, increasing profits, etc.

Business Process vs. Workflow

While "business process" and "workflow" are often used interchangeably and often confused, they are not precisely the same.

While "business process" and "workflow" are often used interchangeably and often confused, they are not precisely the same.

A workflow is a set of activities that helps accomplish a business/organization goal (or goals), and there are three major types of workflows, with process being one of them:

1. Process: or business process, a workflow with predictable steps that is also repeatable. When given the same input, a business process will produce the same (at least very similar) output. In a banking environment, the workflow of loan application approval is a process.

2. Project: a workflow with predictable steps but not repeatable. Developing and launching a new investment product is an excellent example of a banking project.

3. Case: a workflow in which the steps/activities are unpredictable and not repeatable. The required steps will reveal themselves only after more information has been gathered. Handling a customer's complaint is an example of a case in a banking environment.

How BPM Improves Efficiency

TBPM uses various methods and technologies to optimize a business process by:

-

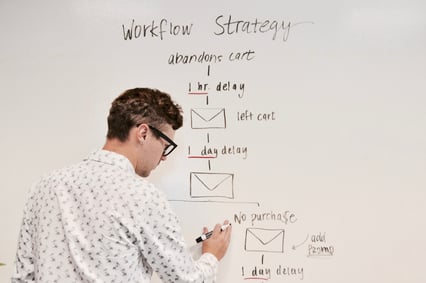

Modeling the business process (i.e., with a visual workflow diagram)

-

Analyzing the business process to identify inefficiencies and bottlenecks

-

Developing an optimization plan to eliminate these bottlenecks and improve the business process

-

Optimizing the business process based on the optimization plan

-

Monitoring the new business process and re-optimize it as needed

It's important to understand that BPM implementation (including banking) is a dynamic process rather than a static one. The bank's objectives, organizational policies, internal roles, tactics, and competitive landscape, among other factors, are constantly changing, so the business process must be continuously improved to tackle the evolving challenges.

Common Banking Business Processes and Their Bottlenecks

While every bank is unique, and each may have its unique business processes, here are the standard banking processes that can be found in most banks:

1.Core banking processes

Core banking operations like KYC (Know Your Customer) validation process, customer data validation and updates, accounting processes (including reconciliations), overdraft protection, and so on are expected to be fast and accurate.

On the other hand, optimizing all these core processes can be very challenging due to their complexities. In recent years, automation, primarily via RPA (Robotic Process Automation,) has been a viable solution to improve the speed and accuracy of these core banking operations.

2. Credit and debit card processing

Credit and debit card processing demands accuracy in capturing data across multiple channels, which can be highly demanding.

When performed manually, credit/debit card processing is time-consuming and labor-intensive, and prone to errors and bottlenecks.

3. New customer onboarding

Many banking institutions still rely on manual methods of performing KYC and gathering customer information, which is time-consuming and prone to inconsistencies/errors. Not to mention, with the rapid increase in scams/frauds, more comprehensive KYC processes are now a necessity.

In modern banking, an optimal KYC process may require collecting and validating customer data from multiple sources, which can be time-consuming and error-prone when performed manually. This is where BPM and automation can help improve the speed and accuracy of the customer onboarding process.

4. Loan processing

Loan processing is another core business process of virtually any banking institution. In practice, it may involve a series of complex and error-prone activities: Pre-qualification KYC, loan origination, underwriting, credit approval, quality check, and so on.

On the one hand, today's customers expect a speedy loan approval process, while the banking institution and load provider wouldn't want to sacrifice fraud detection and overall security.

Optimization and automation of the loan processing process to ensure optimal speed and security when handling vast volumes of loan applications are essential in any modern banking institution.

5. Risk and compliance management

The banking and financial sector is heavily regulated, and any banking institution must comply with relevant regulations. Not to mention, financial rules and policies are updated regularly, and the creation of new regulations is also standard in the industry.

Risk and compliance management is a core function of any banking and financial institution. BPM can help these institutions streamline core compliance/risk management functions like fraud checks, anti-money laundering checks, identity verification, and more to ensure the institution is audit-ready.

BPM Implementation in Banking Institutions

While virtually every business and organization can benefit from BPM and improved efficiency with Business Process Management Software, some unique nuances should be considered when aiming to implement BPM in the banking sector:

1. Increased demand for more speed

Being one of the oldest sectors, the banking industry has significantly evolved since its early days.

Just a few decades back, slow and disruptive business practices were somewhat accepted (even expected) by customers in banking transactions. However, that's no longer the case these days. There have been increased demands for improvements in banking institutions' sophistication, speed, and accuracy of both back-office and front-office business processes.

However, due to the nature of the banking industry, improved speed and agility must be achieved so that it doesn't sacrifice accuracy and security, which can be easier said than done in practice.

2. Rise of omni-channel banking

Younger customers now expect banking services, especially customer support, to be accessible anywhere and anytime.

This is why omnichannel banking operations: mobile banking, internet banking, ATMs, interactive multichannel customer service, and so on are now standard across banking institutions.

Implementing BPM across these multiple channels and sources can be challenging in the long run, with each channel requiring its unique optimization and automation. This should be a significant consideration when designing BPM initiatives for modern banking institutions.

3. Compliance management

It's no secret that banking institutions should always stay compliant with relevant regulations and policies and may be required to update their operations to meet these regulatory standards constantly.

New policies and regulations are regularly being introduced, which may require a significant overhaul of business processes.

When implementing BPM and automation, we should always consider these regulations and policies, and all optimizations implemented shouldn't sacrifice security and compliance.

Benefits of BPM in Banking

Implementing BPM in banking can help bank institutions tackle the three challenges discussed above while improving the overall productivity and efficiency of the institution.

Implementing BPM in banking can help bank institutions tackle the three challenges discussed above while improving the overall productivity and efficiency of the institution.

In practice, BPM and Business Process Management Software can help banking institutions in aligning their operations with overall business strategies in achieving their objectives by:

Achieving objectives with fewer resources

BPM optimizes business processes and (when applicable) automates the process to eliminate repetitive and redundant tasks. This allows the banking institution to save cost and time otherwise spent on these redundant tasks, allowing them to achieve the business objective more efficiently.

Reducing employee workload

Employees can be relieved from executing these time-consuming and often low-value tasks by optimizing, automating, or even eliminating repetitive and redundant steps in the business process. Instead, they can focus their time and contributions on tasks that matter more in achieving the institution's core objectives.

Improved customer satisfaction

Optimal and automated business processes can help bank institutions meet their customer's expectations and improve their customer service excellence across multiple banking channels.

Fast and efficient customer support ensures customers' questions and issues are answered quickly and effectively, improving customers' satisfaction and loyalty.

Improved operational agility

Banks are also expected to be more flexible and agile due to the rapidly evolving competitive landscape, creation of new policies, updates of new regulations and policies, and so on.

Implementing BPM can bring agility and flexibility into front-office and back-office banking operations, so they are more prepared to adopt future improvements and changes.

Ensuring optimal risk management and regulatory compliance

Banking institutions must always be audit-ready, with regular and even sudden audits standard in the industry. Yet, as discussed, ensuring regulatory compliance can be complicated with the introduction of new policies on a regular basis and with existing policies being updated seemingly every other week.

Optimal and automated risk and compliance management due to the implementation of BPM can ensure banking institutions stay compliant with regulations and policies without sacrificing security and agility.

Business Process Management in Banking: Step-By-Step Guide

Due to the complexity and unique challenges in the banking industry, as discussed above, BPM implementation for banking institutions must be comprehensive and need to cover these different aspects:

-

Activity monitoring: establishing a comprehensive monitoring system for all activities in the current business process to ensure transparency and accountability

-

Optimal human processes: optimizing all operations involving human stakeholders (internal and external)

-

Optimal system processes: optimizing system workflows, system interconnections, and human-system interactions

-

Setting up rules engine: using a capable BPM software to establish a rules engine for automating business processes.

In practice, these can be achieved in five main BPM implementation phases:

-

Identification: mapping the existing business process as-is, typically in the form of a flow chart or workflow diagram, so that we can identify the different elements involved in the business process, such as stakeholders, systems, tasks, dependencies, and rules.

-

Analysis: analyzing the mapped workflow diagram to identify inefficiencies and bottlenecks and develop an optimization plan based on the analysis results.

-

Optimization: applying the optimization plan in a real-world scenario. Actual implementation can start with smaller business processes within a single department, moving to more complex cross-department processes.

-

Evaluation: reviewing the effectiveness of the improved business process and the BPM software implementation. Here we can monitor KPIs like turnaround time, error rate, and cost while comparing them with pre-implementation values.

-

Improvement: based on the evaluation results, further optimizations may be needed. The long-term goal of BPM implementation is the continuous assessment and optimization cycle of business processes.

In practice, we can translate these five phases into several steps:

Step 1: Picking and prioritizing business processes to optimize

Since, most likely, there are multiple business processes in a banking institution, before anything else, it's important to prioritize which business processes to optimize first.

While in the long run, we'd like to map, optimize, and automate all workflows if possible, our time and resources are limited, so we'll need to prioritize.

Which business process to prioritize first? You can use one or more of these three basic approaches to make your decision:

-

Strategic approach: prioritizing the most critical business process for the banking institution. When this process is optimized, it will contribute the most to improving the bank's overall efficiency.

-

Reactive approach: prioritizing a business process or business processes with obvious inefficiencies or issues so that we can fix these inefficiencies faster.

-

Customer-centric approach: prioritizing a business process that will directly impact customer satisfaction, for example, picking processes that will shorten customers' wait time between services.

Once you've picked the business process to optimize, the next step is to gather as much information as you can about this specific process.

Observe the business process from start to finish and interview stakeholders directly involved in the business process. You'd want to get a clear picture of the workflow from start to finish, especially:

-

The start point and end point of the business process

-

All the tasks/activities required to complete the business process

-

The sequence in which tasks/actions must be completed

-

Who's responsible for executing each task

-

The timeline for each task

-

Resources and information needed to complete each task

Step 2: Visualizing the business process

After you've gathered enough data about the business process, the next step is to visualize the business process in a business process diagram.

There are various methods you can use to map the business process, and technically you can do it with just a pen and paper. However, the most popular way is to use the ANSI standard flowchart.

When mapping the business process diagram, it's essential to focus on creating an accurate as-is diagram. Meaning, the diagram should represent how the business process is currently being executed (and not the ideal process you'd like to be executed.)

It's best to use a BPM solution like Aproove with its built-in business process mapping tool for this mapping purpose so that you can perform the next step in the same tool right away.

Step 3: Analyzing the business process

Once you've created an accurate business process diagram, the next step is to analyze this diagram to identify inefficiencies and bottlenecks.

When analyzing the business process, you should pay attention to the following factors:

-

The objective (or objectives) of the business process

-

The requirements for the success of this business process

-

The purpose of each task in the business process

-

Who the business process is going to benefit or serve

-

Whether all steps currently performed in the process are required, or if some can be replaced or eliminated

-

Whether every stakeholder involved in the process has adequate information and resources to complete the task, they're responsible for

Focus on the objective of this analysis phase: identify bottlenecks and inefficiencies to define how you will optimize the business process.

Step 4: Optimization

Based on the analysis results, you can start optimizing the business process to eliminate bottlenecks/inefficiencies and improve the process's efficiency.

When optimizing multiple business processes, it's best first to identify dependencies between each process and optimize them accordingly. This is to minimize downtime as much as you can when implementing BPM.

It's best to start with smaller processes first to minimize risks: start with smaller processes within a single department and then move on to larger/more complex processes, including those that span multiple departments.

When optimizing the workflow, it's crucial to remember that it won't be perfect the first time, and you may need to go back to the drawing board to re-optimize the process again and again.

Also, involve internal and external stakeholders as much as possible throughout the optimization process so they can provide feedback.

Step 5: Monitor

Once optimization has been implemented, the next step is to track these improvements to see how they perform.

The best, most objective way to do this is to track key performance metrics of the business process (which can vary depending on the process's objective.)

For example, if you are optimizing the loan approval process, then the turnaround time is an important KPI to track. Compare turnaround time before and after the process has been optimized to assess whether the improvements have achieved their intended goals and resolved bottlenecks.

Step 6: Reengineering and improvements

Again, BPM is not a one-off process but a continuous one, which is even truer in the banking industry with its complex nuances.

Re-optimize business processes as needed until you've achieved the desired productivity level. Keep in mind that you may need to optimize the process or change it altogether due to external factors (introduction of new policies, changes in the industry landscape, new competitors, etc. )

In the end, continuous improvement of business processes should be the long-term goal of BPM implementation in banking.

Wrapping Up

For banking and financial institutions or other businesses in the banking industry, proper implementation of BPM can help you control the challenging aspects of banking business processes while also improving your organization's overall productivity.

While implementing BPM can be challenging to grasp for some stakeholders, most banking business processes can be optimized in just a few simple steps we've discussed above.

Following the step-by-step guide we've shared above and our actionable tips, you can start optimizing your banks' business workflows immediately and achieve better efficiency in catering to your customers' needs.

Share this

- Featured (23)

- Educational (22)

- New Release (21)

- Online Proofing (20)

- Workflow Management (19)

- Project Management (18)

- Work Management (17)

- Business Workflow (16)

- Newsletter (15)

- BPM Software (10)

- Business Automation (8)

- Workflow Automation (8)

- Marketing Workflow (7)

- Digital Asset Management (6)

- Industry News (6)

- News (6)

- business process workflow (5)

- Marketing management (4)

- BPM (3)

- Marketing Automation (3)

- Task Management (3)

- AI (1)

- Aproove news (1)

- Case Studies (1)

- Case Study (1)

- DAM Software (1)

- Document Management Automation (1)

- Document Workflow Automation (1)

- Insider (1)

- enterprise project management (1)

- insurance work management (1)

- marketing process (1)

- July 2024 (8)

- June 2024 (11)

- May 2024 (6)

- April 2024 (7)

- March 2024 (7)

- February 2024 (6)

- January 2024 (4)

- December 2023 (3)

- November 2023 (7)

- October 2023 (7)

- September 2023 (3)

- August 2023 (5)

- July 2023 (3)

- June 2023 (1)

- May 2023 (1)

- April 2023 (1)

- February 2023 (2)

- September 2022 (3)

- August 2022 (1)

- July 2022 (1)

- May 2022 (1)

- March 2022 (3)

- February 2022 (3)

- January 2022 (3)

- November 2021 (2)

- October 2021 (2)

- September 2021 (1)

- August 2021 (4)

- July 2021 (4)

- June 2021 (2)

- May 2021 (3)

- April 2021 (1)

- February 2021 (1)

- November 2020 (1)

- October 2020 (2)

- July 2020 (4)

- June 2020 (2)

- May 2020 (2)

No Comments Yet

Let us know what you think